Best Finance Homework AI Solvers and Helpers

The educational environment has undergone a considerable transition mainly due to the introduction of AI tools which help learners in their difficult tasks. In fact, students in finance line of study get the worst since they are given the most confusing assignments those from time value of money to portfolio optimization as well as financial statement analysis. However, as one makes the distinction between advanced tech and a growing heap of students depending on AI-powered Homework Solvers to boost up their study, clarify the hard to grasp ideas, and also check their answers, the line continues to blur.

The whole thing has turned out to be a rather hot issue in universities. A lot of the teachers that are against AIs worry about integrity and direct correspondence with technology. On the other hand, some are of the opinion that AI tools could prove to be the best of learning aids that give instant feedback and personalized explanations if they are used correctly. Understanding the usage of the above-mentioned tools is the core issue; Are they student’s supplements to learning or they are replacements for the genuine understanding?

So as to help learners in this challenging terrain, we have tested the performance of several popular AI Homework Helpers particularly in finance cases. Accuracy, explanation quality, complexity adaptability, and overall user experience were the areas of our evaluation.

The AI Homework Phenomenon in Finance Education

Before delving into the specific tools, one cannot overlook the necessity to know the general AI context in academic settings. Today’s students are under unprecedented pressure to keep their GPAs high while also working part-time, doing internships, and joining clubs. The combination of mathematical rigor and conceptual complexity that finance courses have can be particularly challenging.

Teachers with homework problems alongside AI have filled the gap of missing education support. Tutoring services that have limited hours of operation are an example of the old-fashioned ways. Students being able to get help at any time is the new approach; AI tools even offer ways of breaking down the toughest problems one part at a time, explaining the very concepts behind them, and changing their explanations according to the different learning styles.

Nevertheless, with convenience comes significant issues to consider. Academics have expressed serious concerns about students passing off AI-generated work as their own, which is no different from cheating. More importantly, though, is the question of whether the use of AI tools gets students to the point of actually having the deep understanding and problem-solving skills that the financial industry seeks.

The most effective approach that combines AI tools with learning appears to be using AI tools as learning supplements. A student who attends lectures and reviews material but still does not get the concept can use AI for clarification. A student who wants to check his work or comprehend why he got the wrong answer can benefit from AI’s extensive explanations. The most important thing is that students should solve the problems independently and use AI tools as a way of augmenting rather than replacing their learning process.

Testing Methodology

For this review, we created a problem set that mixed easy, medium, and hard issues of the finance area and applied each AI tool. The tests included:

- Basic time value of money calculations (present value, future value, annuities)

- Bond valuation and yield calculations

- Stock valuation using dividend discount models

- Capital budgeting problems with NPV and IRR

- Portfolio theory and CAPM applications

- Financial statement analysis and ratio calculations

- Options pricing using the Black-Scholes model

We compared every tool to the others based on criteria – the final answers correctness, the explanation quality and clarity, the step of showing work, complex multi-part problems handling, user-friendliness, and the overall worth for the student.

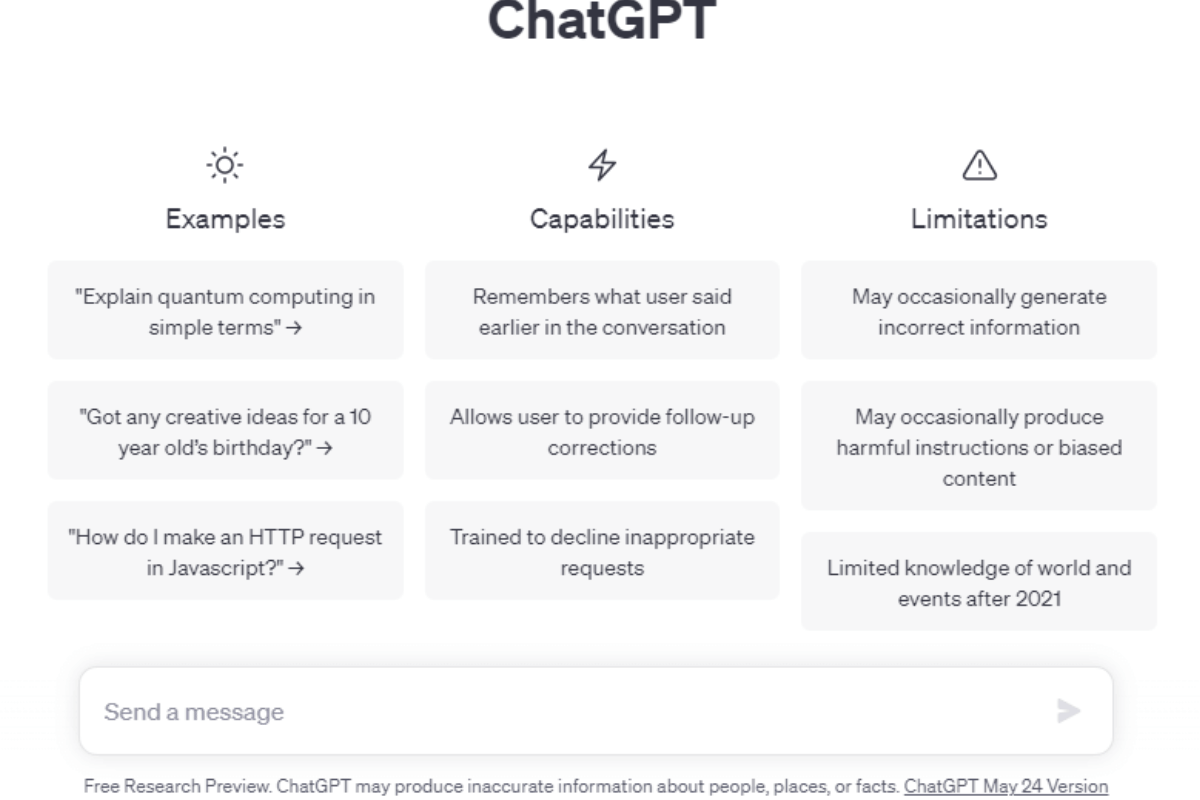

1. ChatGPT (GPT-4)

Overall Rating: 9/10

Overall, the ChatGPT-GPT-4 version has proven to be very effective in the vast majority of finance problems depending on their types. One of its best characteristics is the quality of the explanations that it provides as it does not just present the figures calculated but goes a step further to give the underlying concepts and reasoning as well.

When a bond valuation-based problem is given that requires to find the present value of coupon payments as well as the principal amount, ChatGPT would not only compute the right answer but explain the link between bond prices and interest rates thereby assisting the student in understanding why sometimes bonds are sold at a premium or discount. The explanations were simple but at the same time accurate enough for beginners and technocrats as well.

The AI tool carried out well in handling complicated multi-part queries during our testing. A capital budgeting case that includes an initial investment, numerous years of cash flows, and terminal value calculation, ChatGPT then told the problem in a logical way, made all intermediate calculations, and clarified the decision criteria for project acceptance.

However, arithmetic errors were not altogether absent in lengthy computations, especially in the case of many cash flows. Students, therefore, must independently verify numerical results, especially in the case of high-stakes assignments. The tool, in addition, sometimes needed follow prompts to illustrate all steps in the calculations instead of just giving the final answers.

For students, ChatGPT is a more efficient tool if you involve it through a dialogue. In the case of an unclear explanation, you can either ask for simpler language or request further examples. This interaction makes it very useful for learning, not just for getting answers.

2. Claude

Overall Rating: 9.5/10

Claude has demonstrated top performance in finance homework, even surpassing ChatGPT in most categories. It has, however, the attention to detail in financial calculations and has the tendency to state assumptions upfront as its distinguishing feature. This is very important in finance since different assumptions can give different valid answers.

Through our testing, Claude showed particular expertise with corporate finance problems. While solving a weighted average cost of capital (WACC) problem, it made it a point to explain each component carefully, to discuss why the after-tax cost of debt is being used, and even to mention important real-world considerations such as the difference between book and market values.

The explanations provided by Claude were thorough yet easy to understand. When dealing with a derivatives pricing problem, it gave the Black-Scholes formula components in intuitive terms before applying the formula, thereby helping students understand what each Greek letter represents in practical terms.

Furthermore, the tool displayed a remarkable ability to identify common student mistakes. Having intentionally made an error in setting up a problem, Claude detected the mistake and then clarified the correct approach, thus confirming its role as a learning tool that goes beyond merely providing answers.

One small drawback is that Claude cannot produce any visual aids like graphs or charts that might sometimes be helpful in comprehending concepts such as efficient frontiers in portfolio theory or the bond prices-yields relationship.

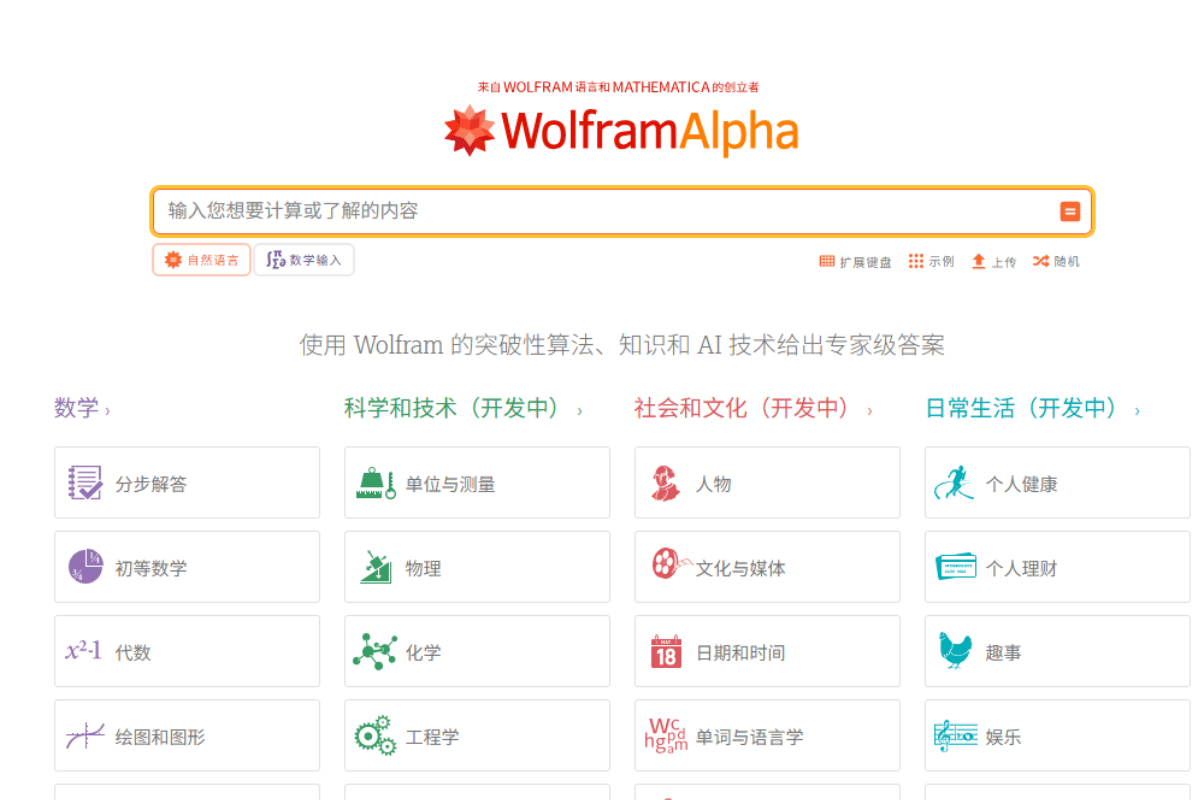

3. Wolfram Alpha

Overall Rating: 8/10

Wolfram Alpha, unlike conversational AI tools, takes a totally different approach and functions as a more mathematical and scientific query-specific computational engine. It is significantly accurate and fast for straightforward finance calculations.

The tool is best at doing accurate numerical computations. Wolfram Alpha provided the exact answers with no rounding errors and the formulas used in the process when calculating the present value of a complex annuity. It can natively handle various financial formulas and understand queries like “present value of $1000 annual payment for 10 years at 5% discount rate.”

On the downside, Wolfram Alpha’s explanations are far less comprehensive than those provided by conversational AI tools. It displays formulas and calculations but does not give the students much of a conceptual explanation. This is ideal for students who understand the concepts already and only need accurate calculations or want to check their work. However, for those trying to learn new concepts, the lack of detailed explanations can be limiting.

Moreover, the interface can be daunting for those not familiar with its syntax. Therefore, one might have to come up with very precise wording for their calculations if their problems are complex. There is a learning curve here regarding the phraseology of financial queries so as to be effective.

For finance students, Wolfram Alpha serves better as a calculator and verification tool rather than a primary learning resource. It is perfect for problem sets checking or fast running of complex calculations, but it is advisable to have other resources for concept understanding.

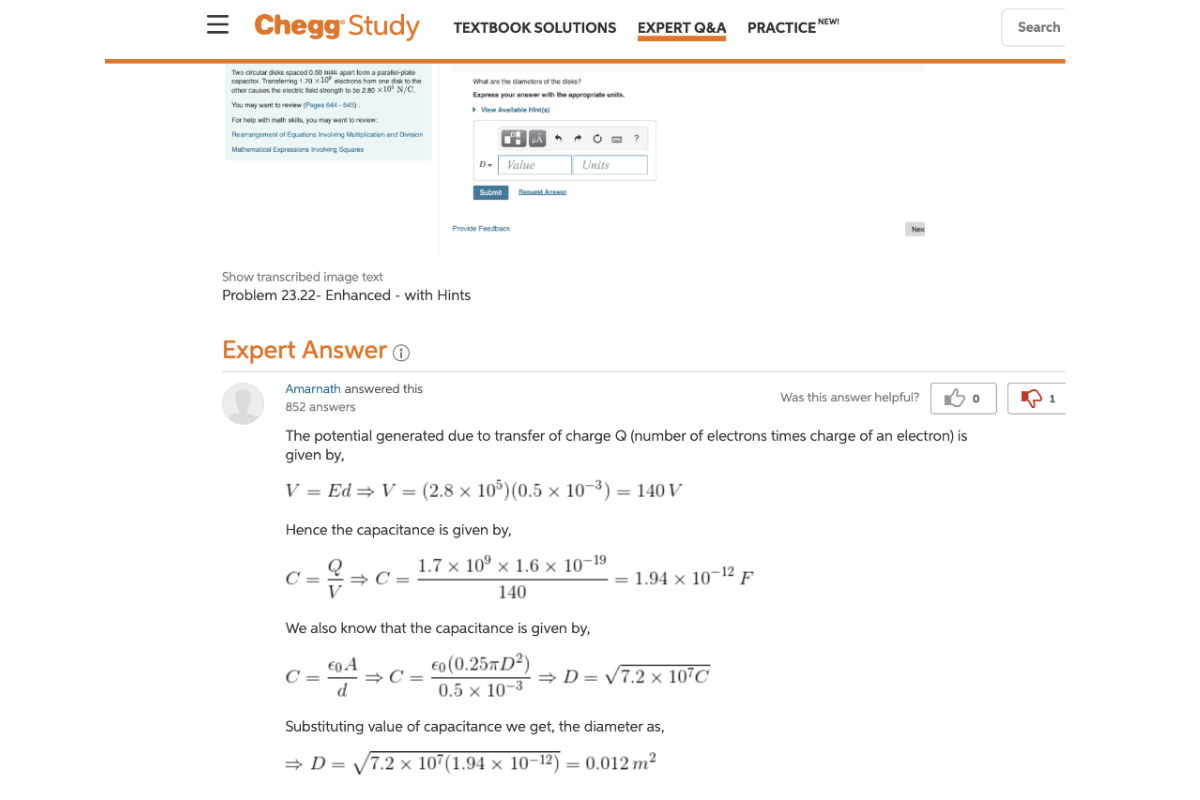

4. Chegg Study

Overall Rating: 7/10

Chegg Study, unlike AI-powered tools, provides access to previously solved problems from textbooks and expert Q&A services as you pay for it. It can be of utmost value for students using common finance textbooks since you might find your exact problem already solved.

The quality of explanations varies a lot depending on who solved the particular problem. Some expert solutions are excellent, with detailed step-by-step work and helpful notes. Others are more perfunctory, providing answers with minimal explanation.

The biggest plus point of Chegg is its huge problem database. During our testing, we found solutions to problems from popular finance textbooks like “Corporate Finance” by Ross, Westerfield, and Jaffe. If you are stuck with a specific textbook problem, there is a high chance that someone has already solved it on Chegg.

However, Chegg requires a paid subscription, which may not be affordable for students with limited budgets. The previously mentioned AI tools, on the other hand, are either free or have free tiers which may be sufficient for many students’ needs. Moreover, finding the right problem can also be difficult sometimes if the database does not include your specific textbook or edition.

The Q&A service allows you to submit new questions, but the response time can vary from a few hours to a couple of days, which is not helpful when you are working on a homework assignment that is due the next day.

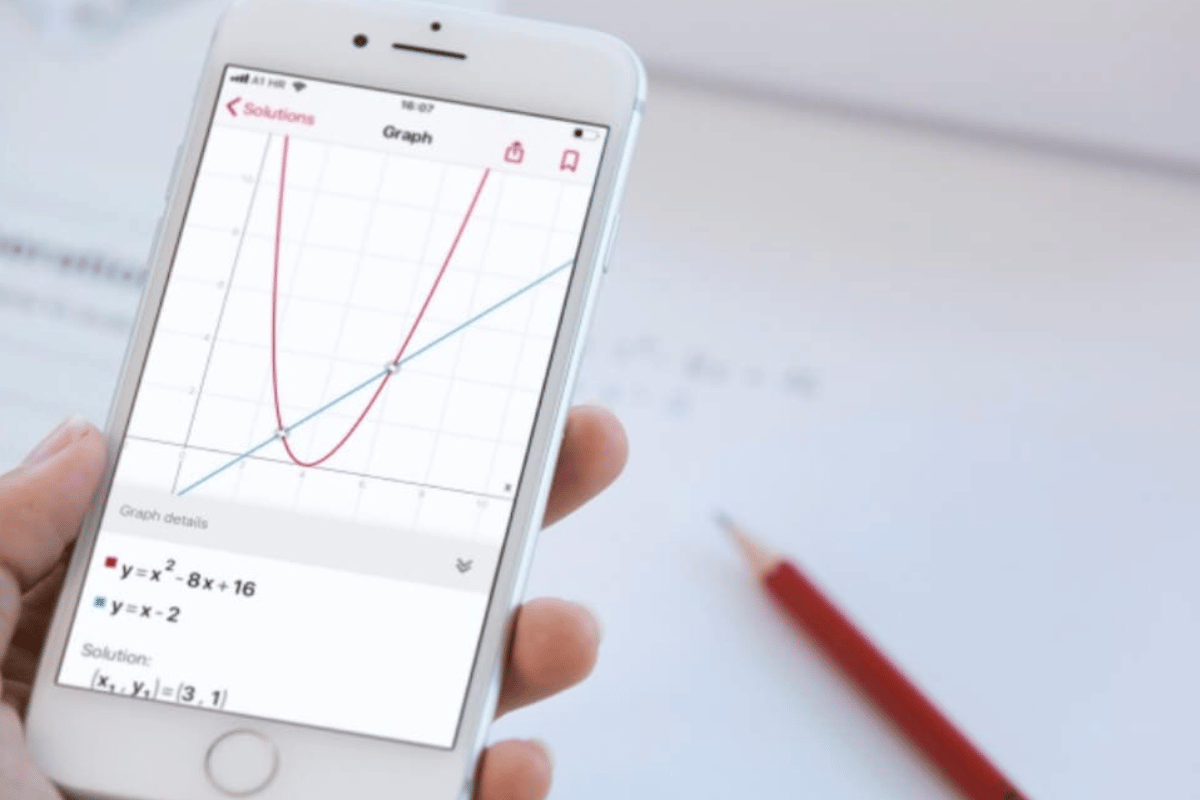

5. Photomath

Overall Rating: 6.5/10

Photomath gives students the ability to take pictures of both handwritten and printed math problems and immediately get the answers. While the app is mainly geared towards general math, it can also manage some calculations related to finance, particularly the ones that have simple formulas.

The application performed quite good with the most basic calculations of time value of money and very simple financial math. The user could take a photo of a question about how much the future value of a certain investment is, and the app would identify the variables, and then would solve the equation step by step.

But, on the other hand, Photomath has difficulties if the finance problems are complex and require multi-step reasoning or conceptual understanding which is beyond pure calculation. The tool is quite bad in recognizing finance-specific terminology or context, thus. Problems that need financial statement analysis, qualitative reasoning, or knowledge of financial markets are completely out of the app’s reach.

The step-by-step solutions do contribute to the comprehension of the mathematical process, but one could say that there are virtually no explanations of financial concepts. The tool does not tell you why a certain formula would be applied or what the result means in financial terms.

Photomath’s usefulness is minimal for finance students. It may, however, assist in verifying simple arithmetic operations, but the more advanced AI chatbots offer a wider range of help for finance coursework.

Responsible Use of AI Homework Helpers

Using AI homework helpers, regardless of the tool you choose, in an ethical and effective way is paramount. These tools should be a complement to your learning, not a substitute. Below are some suggestions for responsible use:

- Attempt Problems First: Always solve the problems by yourself before getting help from AI tools. Struggling with a certain topic is actually a very important part of the learning process. Use AI helpers only after being stuck for a while and not as a first resort.

- Understand, Don’t Copy: The goal should be understanding the solution process, not just obtaining answers. Read through explanations carefully and make sure you could solve a similar problem on your own. If you don’t understand the AI’s explanation, ask follow-up questions or seek additional resources.

- Verify Information: AI tools can make mistakes, particularly with complex calculations. Always double-check important results and be skeptical of any answer that seems surprising or counterintuitive.

- Follow Your Institution’s Policies: Many universities have specific policies about using AI tools for homework. Some professors explicitly prohibit it, while others allow it for checking work but not for initial problem solving. Always know and follow your institution’s academic integrity policies.

- Use as a Learning Tool: The most effective approach is using AI helpers as a supplement to other learning resources. Attend lectures, read your textbook, participate in study groups, and attend office hours. AI tools work best when integrated into a comprehensive learning strategy.

The Future of AI in Finance Education

The integration of AI into education is still in its early stages, and we’re likely to see significant evolution in how these tools are used and regulated. Some business schools are beginning to incorporate AI literacy into their curricula, teaching students how to use these tools effectively and ethically.

There’s also growing recognition that rather than banning AI tools, educators might better serve students by teaching them to use these resources appropriately. In professional finance roles, analysts and managers regularly use sophisticated software tools and data resources. Learning to leverage AI assistance while maintaining critical thinking skills may actually be valuable preparation for finance careers.

At the same time, examination formats may evolve to better assess genuine understanding rather than problem-solving that can be easily outsourced to AI. We may see more emphasis on open-ended analysis, case discussions, and in-person examinations that test conceptual understanding and application rather than routine calculations.

Conclusion

AI homework helpers have become a significant presence in finance education, offering students powerful tools for learning and problem-solving. Our testing revealed that sophisticated AI chatbots like Claude and ChatGPT provide the most comprehensive assistance, combining accurate calculations with detailed explanations that can genuinely aid learning.

However, these tools are most valuable when used responsibly as supplements to traditional learning methods rather than replacements for genuine engagement with course material. Students who use AI helpers to deepen their understanding, verify their work, and gain additional perspectives are likely to benefit significantly. Those who use them merely to complete assignments without learning the underlying concepts are likely to struggle when faced with exams, case competitions, or real-world finance challenges that require true understanding.

The key is approaching these tools with the right mindset: they’re powerful learning aids, not shortcuts. When used thoughtfully and ethically, AI homework helpers can democratize access to high-quality educational support, helping more students succeed in demanding finance coursework and ultimately in their careers.